Can I pay taxes with a credit card?

Have you considered using a credit card to pay your taxes, but aren’t sure if it’s a smart move? On the one hand, charging taxes on a rewards credit card could mean you can earn cash back, points, or miles to spend on travel. On the other hand, you may incur high service fees depending on the amount of tax you charge to the card.

There are many reasons why you might want to pay your taxes with a credit card, but there are also some caveats. Here’s what you need to know when considering your options.

Generally speaking, taxes for the fourth quarter of the year are due before January 15th.

- Taxes from January 1 to March 31 are due April 15

- Taxes from April 1st to May 31st should be paid by June 15th

- Taxes from June 1st to August 31st should be paid by September 15th

Although paying taxes with a credit card often comes with service fees and other fees, it may still be worth it for some reasons.

For example, you might need to meet a minimum spending threshold to get a welcome bonus on a new card, or receive spend-based benefits like elite status miles with an airline card or free night rewards with a hotel card.

Or, you might have a card that offers 0% interest on annual purchases for a certain period, giving you some breathing room to pay off your bill.

Best credit cards for paying taxes

Discover it Miles and PayPal Cashback Mastercard information is independently collected by The Points Guy. The card details on this page have not been reviewed or approved by the card issuer.

daily newsletter

Reward your inbox with TPG daily e-newsletters

Join over 700,000 readers and get breaking news, in-depth guides and exclusive offers from TPG experts

Best tax credit cards compared

Below, you’ll see the typical earn rates for the top credit cards you can use to pay taxes, as well as TPG’s January 2025 estimate of the value of the rewards you’ll earn.

Keep in mind that potential returns are also based on maximizing earnings through the methods mentioned in the “Warning” column – although it does not include the value of any welcome offers you may receive. We also assume that there is a 1.75% fee for payments by credit card (see below for more information).

Your benefit will be even greater if you can claim the convenience fee as a tax deduction for your business (discuss this possibility with your tax advisor).

Different ways to pay taxes

If you owe back taxes to the IRS, you have several payment options. Most people choose one of the following:

- You can pay directly from your bank account and the IRS will not charge any additional fees for these payments.

- You can wire funds from your bank account, but this option usually incurs fees.

- You can mail a check or money order to the IRS without paying anything other than postage and possibly a money order (depending on where you get it from).

If you need more time to pay your taxes, you can ask the IRS for an extension or set up an installment agreement with a payment plan. However, you will need to pay penalties and interest on that payment plan.

You can also pay taxes using a debit card. While the fees are low, you typically won’t earn valuable travel rewards or cash back unless you have a product like the Amex Rewards Checking debit card, which earns you every $2 you spend on eligible debit card purchases 1 point.

This spending rate combined with other conditions may mean it’s better to get another American Express Membership Rewards card.

The information on Amex Rewards Checking debit cards is independently collected by The Points Guy. The card details on this page have not been reviewed or approved by the card issuer.

Fortunately, the IRS allows you to pay your taxes with a credit card through several third-party payment processors. But be warned: These companies can (and often do) add their own fees to your payment. You can view a list of these companies and their convenience fees on the IRS website.

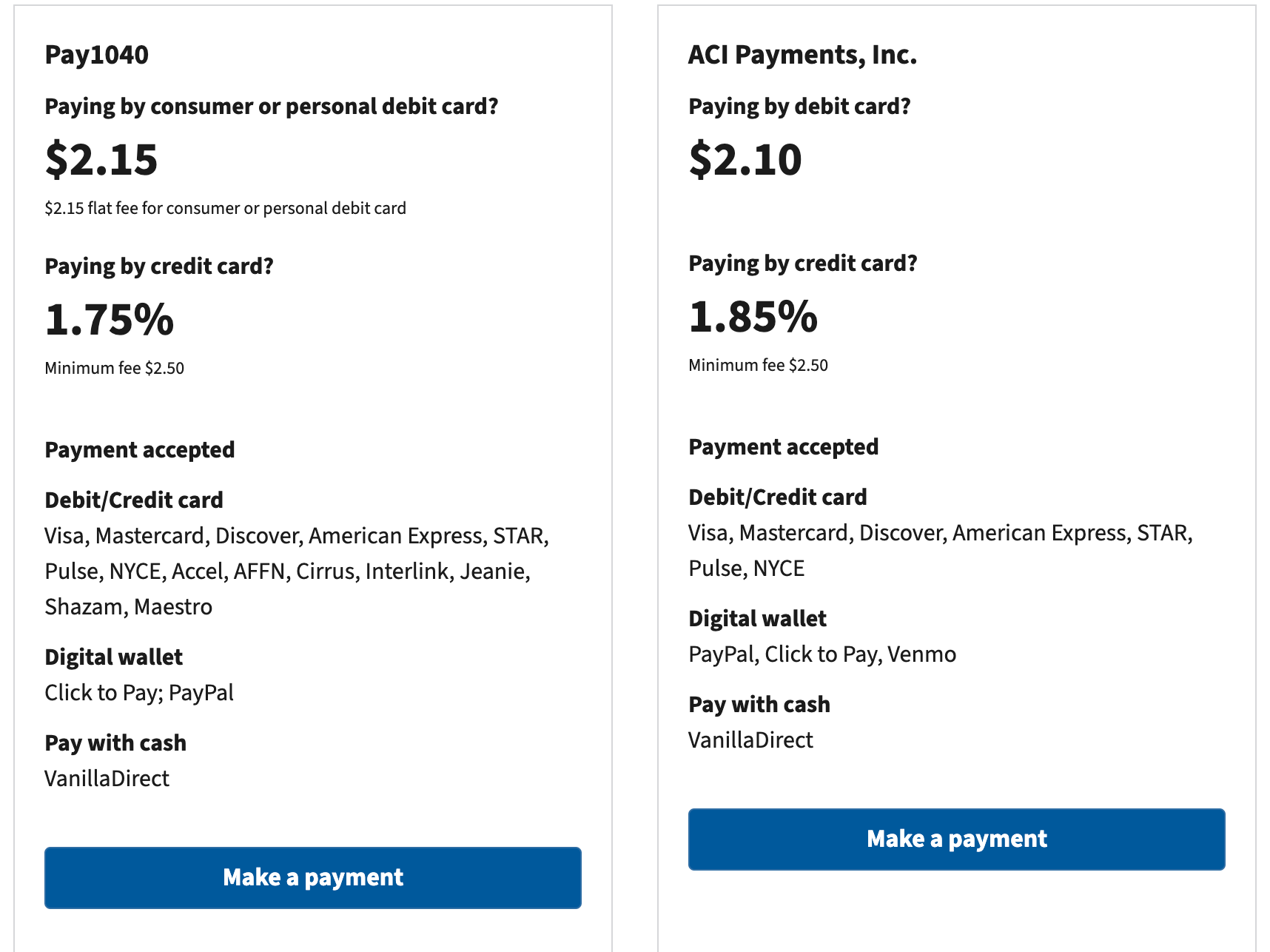

Fees for paying taxes using a credit card

When you pay taxes with a credit card, the fee is calculated as a percentage of the amount paid.

Currently, these fees range from 1.75% to 1.85%. So if you owe $10,000 and want to pay by credit card, you’ll pay an additional fee of $175 to $185, depending on which service you use.

Reasons to use credit card to pay taxes

Despite these surcharges, there are many reasons to use a credit card to pay your taxes.

First, if your new card comes with a 0% APR or no-fee installment plan, doing so can help you earn valuable rewards and give you more time to pay back those hefty taxes. However, if your purchase is subject to normal credit card interest rates, you should strongly consider other options, as paying off your purchase over time can be very expensive.

Here are some scenarios for using a credit card to pay taxes.

Earn huge credit card welcome bonus

Many rewards cards offer welcome offers worth hundreds (sometimes more than $1,000) in cash back, or tens of thousands of points if you spend a certain amount on your new card within a certain time frame.

One of the most important reasons to use a credit card when paying a large tax bill is that you can earn a points windfall on your initial spend with your new card. This is because the value of the points you earn can help offset the cost of paying taxes on your card.

Some travel rewards cards have particularly high minimum spend requirements to earn bonuses, so paying taxes may be just the thing to get you over that threshold.

Typically, you’ll pay taxes with a credit card only if you’re trying to qualify for a huge welcome offer while earning rewards at the regular rate. If you can meet the minimum spending requirements without paying taxes on the card (and incurring those fees), then it’s better to cut your check from the IRS.

Before you choose to pay your taxes with a credit card, make sure you can pay your card balance in full, because if you don’t, you could be hit with interest charges and late fees that can quickly wipe out the value of any rewards You may earn it. The 20% to 25% interest accumulated on your credit card bill can easily offset the 3% to 4% return on your purchases through the points you earn.

Reach the credit card spending threshold

Many credit cards offer benefits that trigger after you reach a certain spending threshold. These rewards may be based on the calendar year or your cardholder anniversary, but in either case, paying a substantial amount of tax can help you earn these rewards when spending amounts may be out of range. For example:

With benefits like these, putting your tax dollars on the right credit card can help you earn valuable perks like elite status upgrades, free night awards, and more.

Spend money for elite status

There are several credit cards that allow you to increase your elite status through credit card purchases, or gain status outright. It may be helpful for you to use one of these credit cards to pay your large taxes, such as:

Use multiple cards to maximize your earnings

If you have a large tax bill, you don’t have to spend the entire amount on one credit card.

The IRS’s page explaining credit card payments says you can only make a maximum of two payments per tax period (year, quarter, or month, depending on the type of tax you pay) using a debit or credit card. But this means you can make two different payments using two different cards.

For example, let’s say you have $28,000 in taxes due. You can apply at the same time American Express Business Platinum Card and the Ink Business Preferred® Credit Card. If you deposit $20,000 within three months of being approved for the American Express Business Platinum Card, you’ll be enough to get a welcome offer of 150,000 points.

Plus, you’ll earn 1.5 points for every $1 you spend on purchases over $5,000 (up to $2 million in such purchases each calendar year and 1 point per $1 thereafter), which means you can Earn 30,000 points on the purchase itself. You can then charge an additional $8,000 of your balance due on the Ink Business Preferred (within three months of approval) and receive a 90,000 welcome bonus and an additional 8,000 points on purchases themselves (1 point per $1 spent on everyday purchases).

In this scenario, you’d end up with more than $6,000 in travel rewards, based on TPG’s January 2025 valuation. (These numbers don’t take into account the points you earn by paying taxes with these cards.)

Get some extra time to pay your taxes

One of TPG’s 10 commandments for earning credit card rewards is to never pay interest. Most importantly, don’t bite off more than you can chew.

When paying taxes with a credit card, be aware of when the first day of the new billing cycle begins for the credit card you want to use. This way, you may have up to 30 days to complete your statement and nearly 60 days to pay off the balance in full.

Some credit cards even offer 0% APR during an introductory period on new purchases, which can provide 12 to 18 months of interest-free payments on your tax bill. You must pay off your entire balance in full before the promotional period ends or face exorbitant interest charges.

Finally, be sure to check if you qualify for an installment plan, as issuers sometimes offer introductory offers.

For example, TPG Senior Editorial Director Nick Ewen was targeted for a free My Chase Plan last year for his Chase Sapphire Reserve®. For any purchase over $100, he has until September 30, 2023 to set up his first plan without paying any fees and There is no interest for the life of the plan (usually between 6 and 18 months) – while still earning rewards.

This can be a great way to finance a large tax bill over time without incurring huge interest payments.

Read more: A comparison of the top buy now, pay later services – and what to look out for

Disadvantages of using a credit card to pay taxes

Despite the benefits listed above, using a credit card to pay taxes can be a reckless strategy because the interest rates on most rewards credit cards can seriously damage your finances if you have to pay taxes.

If you don’t have the no-fee, 0% APR option and you can’t pay your statement balance in full after you charge your taxes to your credit card, you should reconsider using a credit card to pay your taxes.

Instead, consult your tax professional to learn about your options. The IRS offers payment plans with interest rates that are lower than those on most credit cards.

bottom line

Using a credit card to pay your taxes can be a lucrative way to earn points and miles as part of a big welcome offer. Having a 0% APR card also gives you more time to pay off higher tax balances without having to worry about high credit card interest rates, but be sure to do the math yourself to make sure you’re getting value for your money.

The last thing you want is to pay back taxes on top of high credit card interest.

RELATED: The Best Credit Card Welcome Deals This Month

For rates and fees on the American Express Blue Business Plus Credit Card, click here.